Uganda Customs with outdoor power supply

Welcome to our dedicated page for Uganda Customs with outdoor power supply! Here, we have carefully selected a range of videos and relevant information about Uganda Customs with outdoor power supply, tailored to meet your interests and needs. Our services include high-quality Uganda Customs with outdoor power supply-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Uganda Customs with outdoor power supply, including cutting-edge home energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

The history of Uganda''s power supply you may have missed

On May 17, 2004, the concession was signed between the government of Uganda through UEDCL and Umeme Ltd, granting the latter a distribution licence and a supply licence

List Of Exempt Supplies In Uganda

List Of Exempt Supplies In UgandaList Of Exempt Supplies In Uganda Exempt supply is defined in section 2 (47) of GST Act. (47) "Exempt supply" means supply of any goods or services or

Outdoor Lighting – TRONIC UGANDA LIMITED

Explore a variety of outdoor lighting options to enhance your outdoor spaces with TRONIC Uganda Limited.

Uganda airport customs regulations, prohibited items & food

Get import & export customs regulations, restricted items and food restrictions before travelling to Uganda. Items allowed to import is Perfume and eau de toilette up to

Customs and Excise Act

An Act to establish a separate Customs and Excise Department for Uganda to replace and supersede the East African Department of Customs

Customs Compliance: What importers should know | Press release

Uganda''s self-assessment tax system requires importers to declare goods for customs purposes through clearing agents. These declarations and supporting documents are

Understanding Customs Duties and Compliance Requirements in Uganda

This comprehensive guide explores customs duties in Uganda, detailing their importance for the economy, types of duties, duty rates, and exemptions. Learn about

Navigating Import and Export Regulations in Uganda: A

This comprehensive guide highlights the vital steps traders must take to navigate the complexities of international trade in Uganda, including documentation requirements,

Uganda Import Requirements

File Bill of Entry and other documents to complete customs clearing formalities. Determine import duty rate for clearance of goods. What products are tax exempt in Uganda? The exemption is

Understanding Customs Duties and Compliance

This comprehensive guide explores customs duties in Uganda, detailing their importance for the economy, types of duties, duty rates, and

UGANDA CUSTOMS

A Leader in Combating Counterfeit and Transnational Crime The Uganda Revenue Authority (URA) is the primary agency re-sponsible for enforcing customs and trade laws in Uganda.

Customs Duty in Uganda

In this blog article, we will explain what customs duty is, how it is calculated, and what exemptions and reliefs are available for different types of

Shop 100W Eg012 Portable Power Station Supply 76.8WH

Shop 100W Eg012 Portable Power Station Supply 76.8WH Portable Solar Power Generator Energy Storage Power Supply AC/DC Sine Wave Output with 30W Solar Panel LED Screen

Restricted Products requiring Permits/Licences – Ministry of

Under sections 3 and 4 of the External Trade Act, Cap.88), In exercise of the powers conferred to the Minister of Trade, Industry and Cooperatives, The Minister may from

Which goods does Uganda Revenue Authority exempt from taxation?

The VAT Act (Section 20) defines an exempt import if the goods being imported are exempt from customs duty as stated in the Fifth Schedule of the 2004 East African Community Customs

Customs Duty in Uganda

In this blog article, we will explain what customs duty is, how it is calculated, and what exemptions and reliefs are available for different types of goods and traders. We will also

Fixing the electricity genie: The challenge of keeping

Not so long ago, Uganda was in an electricity quagmire – with big chunks of the country witnessing more darkness that light. Over the past few

Power Backup Systems in Uganda: Ensuring Reliable Energy

The Importance of Power Backup Systems in Uganda Reliable Energy Supply: Power backup systems serve as a reliable alternative source of electricity during power outages. They ensure

Uganda

Includes import documentation and other requirements for both the U.S. exporter and foreign importer.

Uganda Import Requirements

Under sections 3 and 4 of the External Trade Act, Cap.88), In exercise of the powers conferred to the Minister of Trade, Industry and Cooperatives, The Minister may from

Buy Reliable UPS Systems

Ensure uninterrupted power with our reliable Uninterruptible Power Supply (UPS) systems. Perfect for home offices and enterprises, available at the best price

Uganda

Uganda, Kenya, Tanzania, Rwanda, and Burundi have adopted a three-tiered duty structure for imports from outside the East Africa Customs Union (EACU) under the terms of

How To Calculate Import Duty In Uganda

What Is Import Duty? Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and

Customs Compliance: What importers should know | Press

Uganda''s self-assessment tax system requires importers to declare goods for customs purposes through clearing agents. These declarations and supporting documents are

In Figures: A Look at Uganda''s Energy Sector

The Generation segment of the Electricity Supply Industry has a combination of the Government of Uganda-owned power plants, Independent Power Producers (IPPs), and

Uganda Customs Regulations in 2025, Duty-Free Allowance Limits

Learn about customs regulations before traveling to Uganda in 2025: import regulations, duty-free allowance, prohibited and restricted items.

FAQs 6

Can I import or export goods from Uganda?

If you are planning to import or export goods to or from Uganda, you need to be aware of the customs duty regulations that apply. Customs duty is a tax levied on goods that cross international borders, and it can affect the cost and profitability of your business transactions.

What are customs duties in Uganda?

Customs duties are essential revenues for the Ugandan government and play a significant role in regulating trade while ensuring compliance in the import and export of goods. In Uganda, the primary types of customs duties include import duties, export duties, and specific tariffs. Import duties are levied on goods brought into the country.

How much is import duty in Uganda?

Generally, these rates vary, with most products attracting an import duty that ranges from 0% to 25%. However, certain categories may incur higher rates depending on the specific product classification and the applicable laws governing trade and customs in Uganda.

Are You complying with Uganda Customs regulations?

As you know, customs regulations widely depend on the country. Before traveling to (or from) Uganda make sure to check the allowance and limits for the next things: Check the information below to be sure that you are complying with Uganda customs regulations. 250 grams total of any tobacco products. Restricted to travellers 18 years and over.

Why is comprehensive documentation important for import and export activities in Uganda?

When engaging in import and export activities in Uganda, comprehensive documentation is essential to ensure compliance with customs regulations and to facilitate the smooth movement of goods across borders.

What is the difference between export and import duties in Uganda?

The Ugandan Revenue Authority (URA) has established specific duty rates depending on the classification of the goods, which can range from zero percent for essential items to varied rates for luxury goods. Export duties, on the other hand, are charges imposed on goods leaving Uganda.

Related links

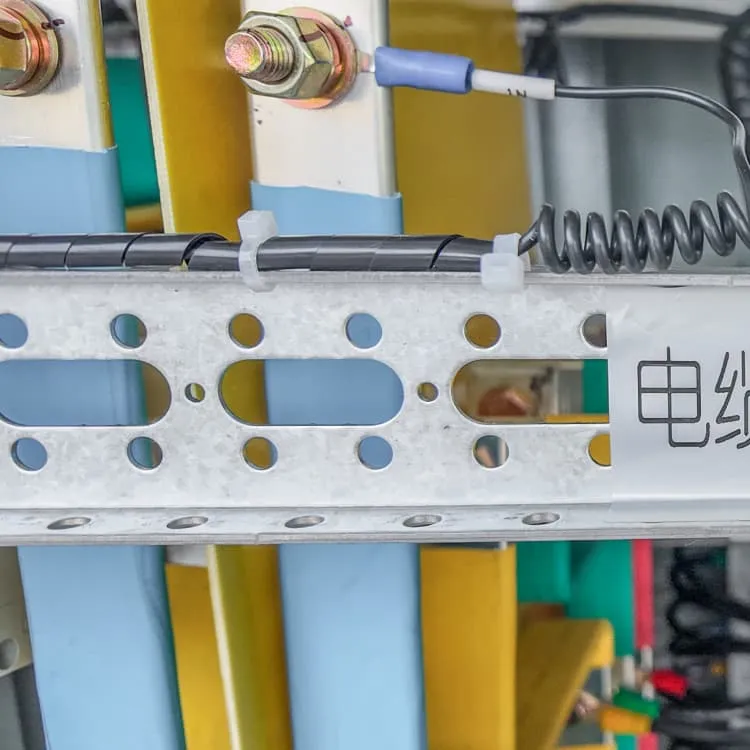

- Uganda Outdoor Power Supply Lithium Battery Replacement

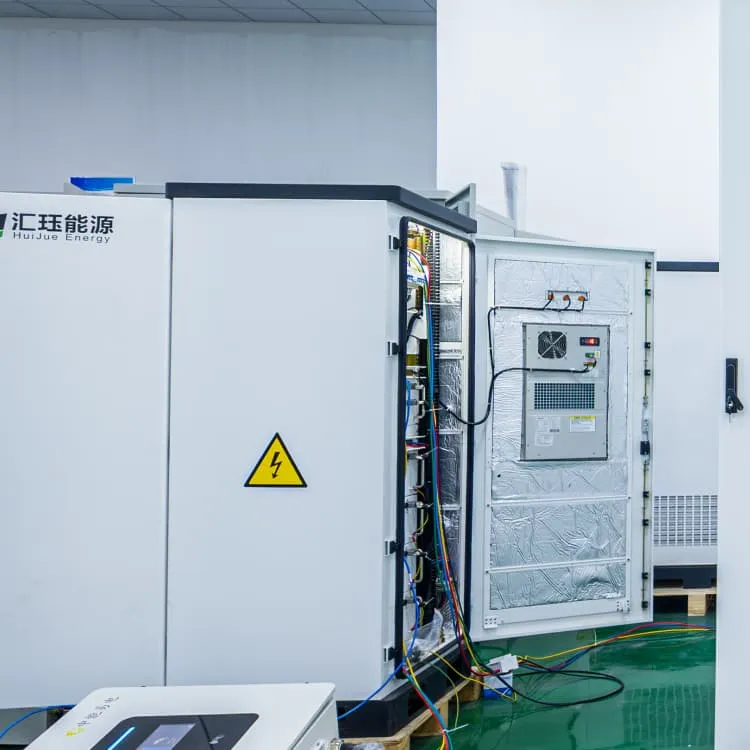

- Huijue Uganda outdoor power supply procurement

- How much does it cost to pass customs for an outdoor power supply in Morocco

- Liechtenstein outdoor power supply can pass customs

- Can I bring an outdoor power supply to customs

- Uganda communication base station power supply cabinet price

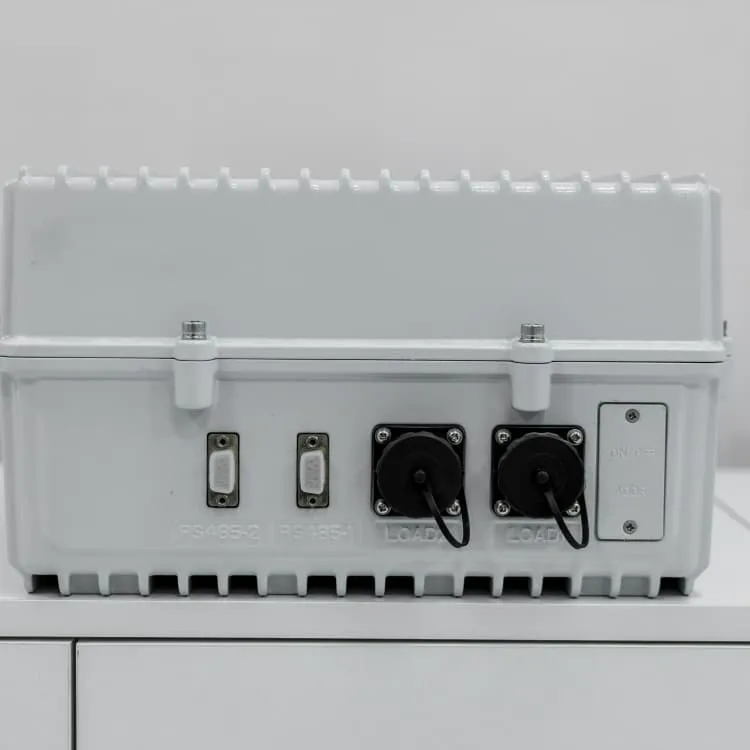

- Environmental introduction of outdoor power supply

- One-to-two outdoor power supply

- Integrated outdoor circular base station power supply method

- Outdoor power supply customized lithium battery of various models and capacities