Tax rate for power supply services for communication base stations

Welcome to our dedicated page for Tax rate for power supply services for communication base stations! Here, we have carefully selected a range of videos and relevant information about Tax rate for power supply services for communication base stations, tailored to meet your interests and needs. Our services include high-quality Tax rate for power supply services for communication base stations-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Tax rate for power supply services for communication base stations, including cutting-edge home energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

Property Taxation of Communications Providers, A

The report would include an overview of state practices and an examination of recent state reforms to modernize property tax systems in

Hybrid Power Supply System for Telecommunication Base Station

Furthermore, the power supply showed peak power shaving of 5kW; thus, reducing the reliance on the grid as well as increased the energy-efficient of this hybrid power supply

Internal Revenue Service Department of the Treasury

Based on the facts as represented by Taxpayer, we conclude that Taxpayer''s wireless communication towers, broadcast communication towers, and the sites on which such

Resource management in cellular base stations powered by

This paper aims to consolidate the work carried out in making base station (BS) green and energy efficient by integrating renewable energy sources (RES). Clean and green

Telecom Taxation Guide: Taxes, Surcharges, Calculating,

The communications industry is one of the most taxed and regulated. Gain a deeper understanding of telecom tax obligations with our comprehensive guide.

Base stations

The power of a base station varies (typically between 10 and 50 watts) depending on the area that needs to be covered and the number of calls processed. This is low compared to other

The Valuation of Towers and Associated Real Property

The primary focus of this report is on wireless telecommunications towers, however, the information can be applied to any type of tower located in a municipality. Communication

Property Taxation of Communications Providers, A Primer for

The report would include an overview of state practices and an examination of recent state reforms to modernize property tax systems in ways that encourage broadband

The Valuation of Towers and Associated Real Property

Recently, there has been much discussion regarding the taxability of some of the components found at a tower site. The taxability of certain components, particularly antennas and electronic

Telecom Taxation Guide: Taxes, Surcharges,

The communications industry is one of the most taxed and regulated. Gain a deeper understanding of telecom tax obligations with our comprehensive guide.

Base Stations

Base stations form a key part of modern wireless communication networks because they offer some crucial advantages, such as wide coverage, continuous communications and

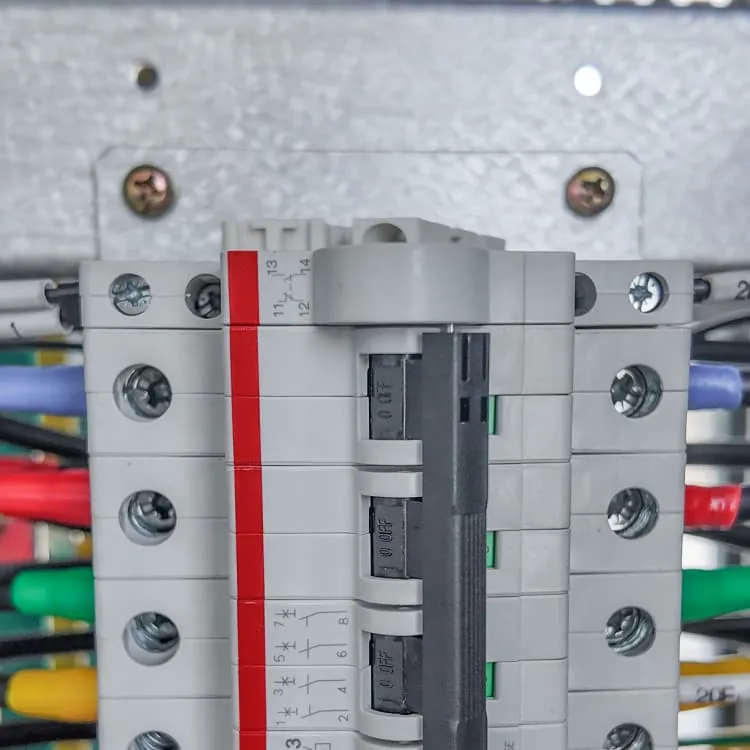

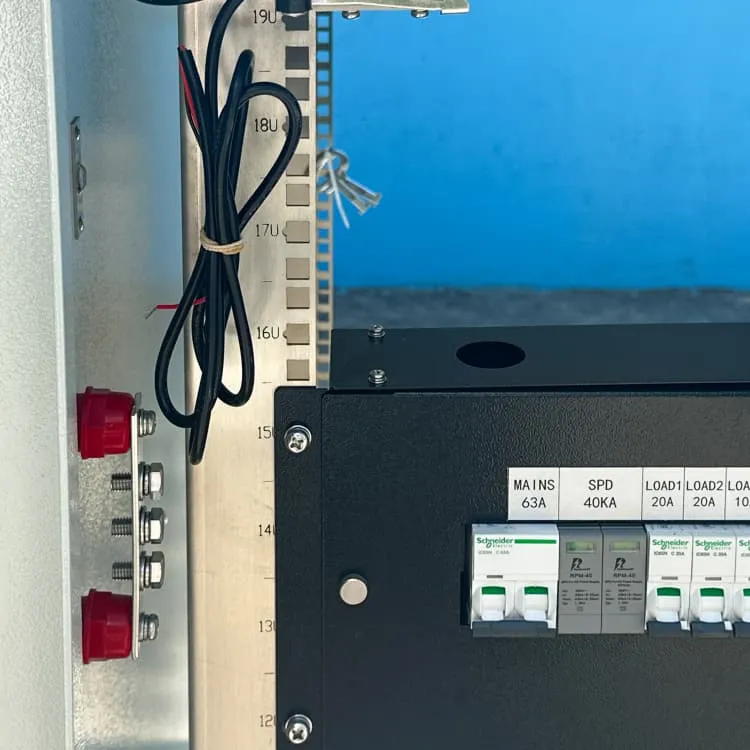

Building a Better –48 VDC Power Supply for 5G and

Figure 3. A power supply for a 5G macro base station block diagram. Highlighted ICs The MAX15258 is a high voltage multiphase boost controller with an I 2 C

Wireless Facility Siting: Section 6409(a) Checklist

Radio transceivers, antennas, coaxial or fiber-optic cable, regular and backup power supplies, and comparable equipment, regardless of technological configuration (including Distributed

Communications tax is not like sales tax. Here''s what

You''ll need to figure out which federal, state, and local jurisdictions require what types of communications tax, including those triggered across

Base Stations

Base stations form a key part of modern wireless communication networks because they offer some crucial advantages, such as wide

Property Taxation of Communications Providers, A Primer for

Introduction and Overview the primary revenue source for local governments in the United States. However, state constitutions and statutes determine the rules under which local governments

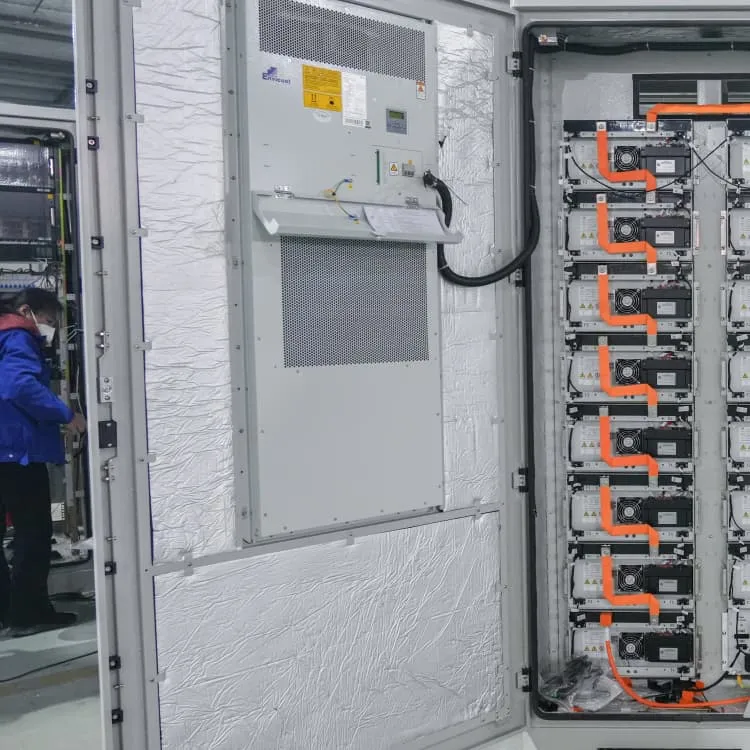

Communication Base Station Energy Solutions

Many remote areas lack access to traditional power grids, yet base stations require 24/7 uninterrupted power supply to maintain stable communication

Hybrid Power Supply System for Telecommunication Base Station

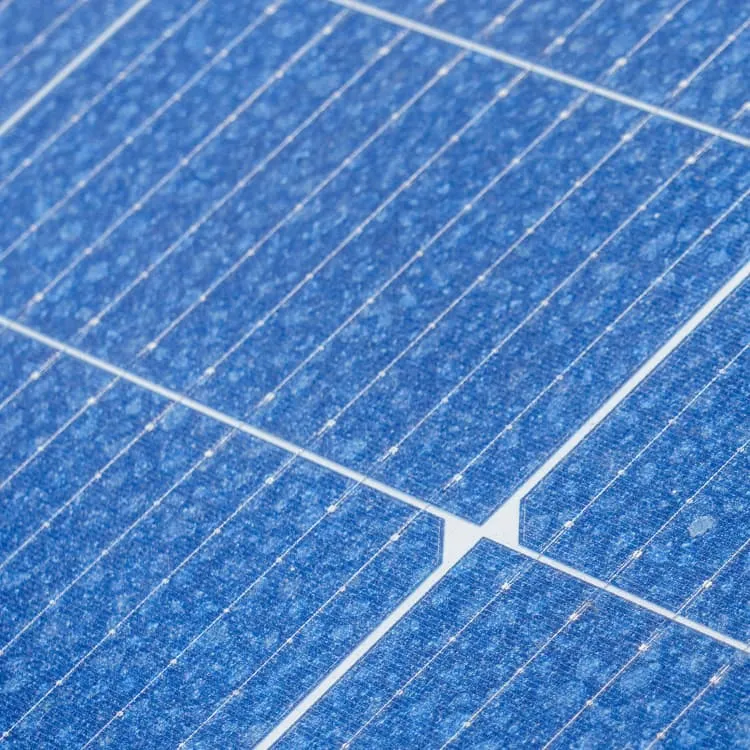

This research paper presents the results of the implementation of solar hybrid power supply system at telecommunication base tower to reduce the fuel consumption at rural area. An

Site Energy Revolution: How Solar Energy Systems

Why Solar Energy for Communication Base Stations? Communication base stations consume significant power daily, especially in

Energy-efficiency schemes for base stations in 5G heterogeneous

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

Base Station Power and User Group Rate Allocation Scheme of

To improve the energy utilization in the joint sensing and communication beamforming system of a cell-free massive MIMO system, we propose a power allocation scheme for different power

Study on Power Feeding System for 5G Network

High Voltage Direct Current (HVDC) power supply HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of

Telecom Base Station PV Power Generation System Solution

Single Photovoltaic Power Supply System (no AC power supply) The communication base station installs solar panels outdoors, and adds MPPT solar controllers and other equipment in the

Radio Base Stations for Secure Communication

In the world of radio communications, a radio base station plays a vital role in ensuring reliable and seamless communication across a wide area. Whether used in mobile networks,

Optimization of Communication Base Station Battery

In the communication power supply field, base station interruptions may occur due to sudden natural disasters or unstable power supplies. This work studies the optimization of

Communication Base Station Energy Solutions

Many remote areas lack access to traditional power grids, yet base stations require 24/7 uninterrupted power supply to maintain stable communication services.

Publication 4164: Communications Excise Tax Explained

The current tax rate is 3% of the amount billed for taxable services. It is a percentage-based tax, meaning the total amount of tax depends directly on the cost of the

Communications tax is not like sales tax. Here''s what you need to

You''ll need to figure out which federal, state, and local jurisdictions require what types of communications tax, including those triggered across your supply chain.

FAQs 6

Are telecommunications providers taxable?

Defining the personal property of telecommunications providers as “real property” so that it is taxable in states that do not tax personal property, or otherwise taxing the personal property of communications providers while exempting the personal property of other competitive businesses.

Should states exempt communications network equipment from sales and use tax?

Be it therefore resolved, that the National Conference of State Legislatures recommends that states who wish to encourage broadband deployment consider exempting communications network equipment from the sales and use tax.

Are communications companies taxable?

The communications marketplace has changed, but some states’ tax laws and practices have not. Delaware, New Jersey, and Wisconsin tax the tangible personal property of some communications companies while exempting the personal property of other businesses.

Should communications tax providers be included in tax bases?

As communications tax authorities work to catch up with the pace of technology innovation, there is some confusion for providers. If your company is selling the latest and greatest products and services, there may be controversy about their inclusion in various tax bases.

Do I have to pay taxes on a telecommunications service?

Depending on the types of communications you provide customers or that your products access, you might be liable to collect and remit taxes and fees including 911 and 988 fees, the Federal Universal Service Fund (FUSF) fee, telecommunications relay services (TRS) fees, utility user tax (UUT), and the communications services tax (CST).

Can a telecommunications tower be taxed?

A telecommunications tower, when it is also used as antennae for broadcasting signals, is often excluded from taxation under RPTL Section 102(12)(I)(D). There is a tower owned by AAA Tower Company located in Onondaga County along a busy thoroughfare.

Related links

- Power supply location of US communication base stations

- Construction and installation of power supply for communication base stations

- What types of power supply are there for internal communication base stations

- Solar backup power supply for Azerbaijan communication base stations

- Hybrid power supply for communication base stations

- Replacing wind power supply for communication base stations

- Power supply for various communication base stations

- Power supply price for solar equipment in communication base stations

- Power supply information for flow battery equipment in communication base stations

- Ten things not to do with power supply for communication base stations