Is energy storage equipment considered an asset

Welcome to our dedicated page for Is energy storage equipment considered an asset ! Here, we have carefully selected a range of videos and relevant information about Is energy storage equipment considered an asset , tailored to meet your interests and needs. Our services include high-quality Is energy storage equipment considered an asset -related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

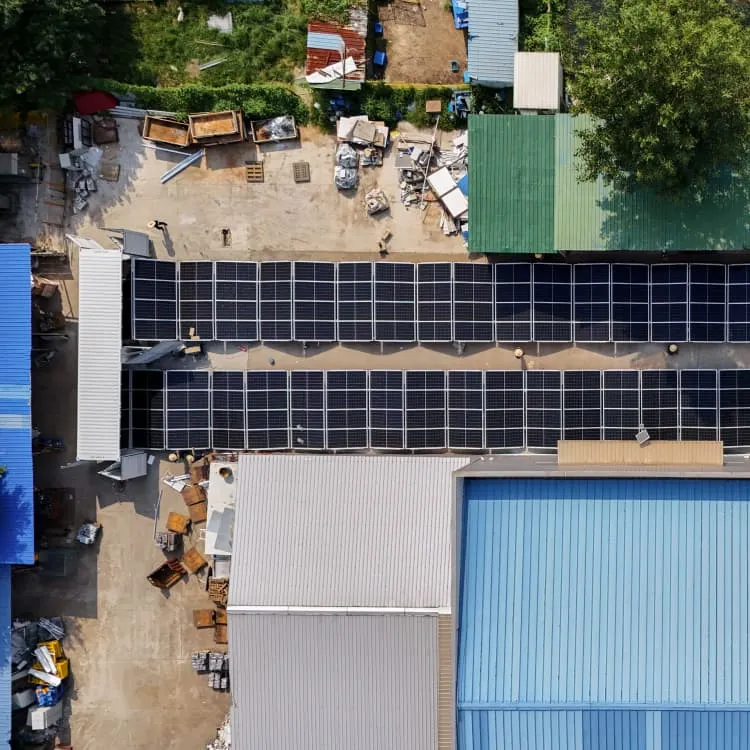

Wherever you are, we're here to provide you with reliable content and services related to Is energy storage equipment considered an asset , including cutting-edge home energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

Energy storage on the electric grid | Deloitte Insights

Energy storage is critical for mitigating the variability of wind and solar resources and positioning them to serve as baseload generation. In fact, the time is ripe for utilities to go "all in" on

Tax Benefits on Depreciable Assets for Commercial

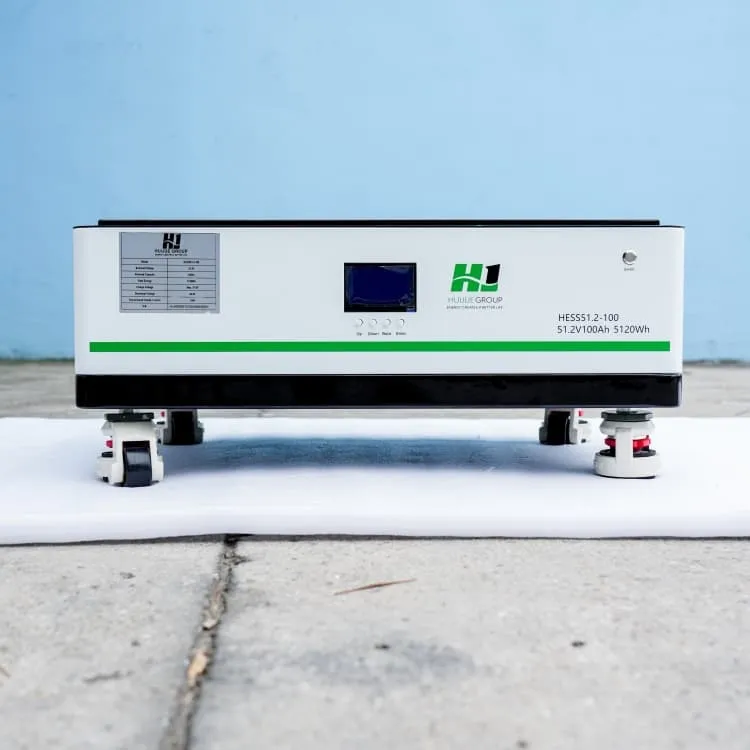

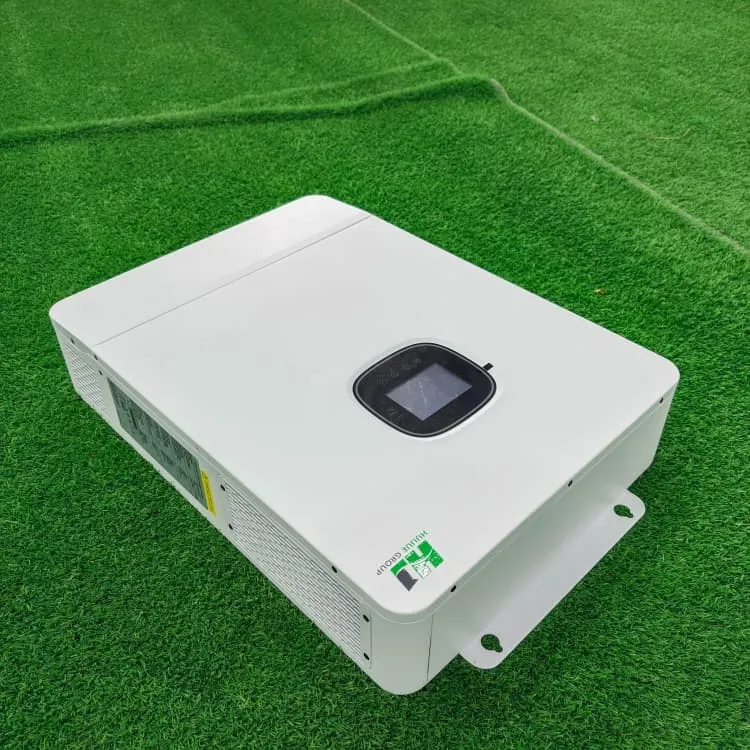

Depreciable Assets: Solar panels, inverters, mounting hardware, wiring, and battery storage equipment are all considered depreciable assets

Cost recovery for qualified clean energy facilities, property and

Under Internal Revenue Code Section 168 (e) (3) (B), qualified facilities, qualified property and energy storage technology are considered 5-year property. These types of

CHAPTER 10.1 Accounting for Property, Plant and

Assets constructed or fabricated by contractors should be capitalized according to the total contract costs incurred by the contractor constructing or fabricating of the asset, including both

Tax Benefits on Depreciable Assets for Commercial Businesses

Depreciable Assets: Solar panels, inverters, mounting hardware, wiring, and battery storage equipment are all considered depreciable assets under MACRS. Installation costs

Investment tax credit for energy property under section 48

As clarified by the final regulations, the unit of energy property for hydrogen energy storage property includes above-ground storage tanks, underground storage facilities and associated

Financing standalone battery storage: the Inflation

Under this structure, the tax equity investor invests capital into a special purpose vehicle that is set up by the developer and which is treated as a partnership

The proper classification of fixed assets — AccountingTools

Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment.

Energy Transition: lease considerations in respect of power

Even when the underlying wind and solar energy generation equipment does not meet the definition of a lease, other assets associated with a PPA may meet the definition of a lease

2.3 Evaluating other contracts for leases

The economic benefits produced by a renewable generation facility (i.e., energy, RECs) differ from those produced by a storage asset (i.e., storage capacity). Similarly, the relevant decisions

Renewable Energy Storage Facts | ACP

Energy storage allows us to store clean energy to use at another time, increasing reliability, controlling costs, and helping build a more resilient grid. Get the clean energy storage facts

Guide to the Federal Investment Tax Credit for Commercial

Overview The solar investment tax credit (ITC) is a tax credit that can be claimed on federal corporate income taxes for 30% of the cost of a solar photovoltaic (PV) system that is

FERC Establishes Revised Accounting Rules to Address

On June 29, the Federal Energy Regulatory Commission (FERC or Commission) issued Order No. 898, a final rule that revises FERC''s Uniform System of Accounts (USofA) by

SALT and Battery: Taxes on Energy Storage | Tax Notes

Traditional battery storage consisted of one or two units located next to commercial and industrial property, and jurisdictions would generally classify the foundation and shell as

IRS Releases Final Energy Property Regulations Under Section

Components include equipment such as storage devices, power conditioning units, and transfer equipment integral to generating or utilizing energy. A unit of energy property is

FERC Nod To Energy Storage As Transmission Has Caveats

The Federal Energy Regulatory Commission has been receptive to electric storage, and has adapted regulatory constructs to enable electric storage facilities to perform varied and

Can Utilities Rate Base Energy Storage as a Distribution Asset?

Can utilities rate base energy storage as a distribution asset? Texas is now tackling this big question, with the potential to set policy that could have national ramifications. The

Optimizing Asset Management for Energy Sector | Grid

Improve energy asset management with Grid''s optimal asset allocation, centralized inventory, and preventive asset maintenance for maximum

Lease Accounting Considerations for Battery Energy Storage

Below are factors to consider in determining if a BESS can be used independently and is, therefore, an identified asset. Factors that could indicate the BESS is not an identified

Final Regulations Define "Real Property" for REITs:

The Final Regulations are generally consistent with the Proposed Regulations in their treatment of renewable energy assets: smaller-scale renewable energy systems that

Energy storage as a transmission asset: Definitions and use cases

This paper reviews regulatory proceedings to define three types of energy storage assets than can interact with the transmission system: storage as a transmission asset,

Chapter 09

Purpose. This chapter establishes the DOE inventory and related property managerial accounting policies and general procedures defined by statutory requirements, FASAB, and other Federal

Lease Accounting Considerations for Battery Energy

Below are factors to consider in determining if a BESS can be used independently and is, therefore, an identified asset. Factors that could

Publication 946 (2024), How To Depreciate Property

A qualified smart electric meter is any time-based meter and related communication equipment, which is placed in service by a supplier of electric

COMMENTS

What is the policy on providing personal property to contractors? The initial premise regarding the provision of Government personal property is that contractors are expected to furnish all

Depreciation on Clean Energy Facilities, Property, and

The federal government offers tax programs and resources for cost recovery through depreciation for qualified clean energy facilities, property, and technology. Depreciation is an annual income

FAQs 6

Is a stand-alone energy storage a qualified person?

Notably, no NAICS code describes stand-alone energy storage, and there is no published guidance on whether a stand-alone BESS could be a qualified person. Stand-alone BESS is subject to property tax. Texas offers an incentive program referred to as chapter 312 to attract new capital investment that has benefitted renewable development.

What is a battery energy storage system?

Battery energy storage systems (BESS) are often referred to as the game changer when it comes to delivering clean energy. Since 2005, the emergence of renewable energy resources like solar and wind has increased the intermittency of energy on the grid and the need for a resource to stabilize generation.

How do you classify a battery storage unit?

Traditional battery storage consisted of one or two units located next to commercial and industrial property, and jurisdictions would generally classify the foundation and shell as improvements to real property — with the remaining equipment classified as machinery and equipment.

Do energy storage systems qualify for a manufacturing exemption?

The Texas comptroller has published at least two private letter rulings explaining that energy storage systems do not qualify for the manufacturing exemption because the batteries are for storing the energy, and storage is not essential to generating the energy. 17

What is a tax payer's basis in a thermal energy storage property?

The final regulations further provide that a “taxpayer’s basis in the thermal energy storage property includes the total cost of the thermal energy storage property and HVAC system less the cost of an HVAC system without thermal storage capacity that would meet the same functional heating or cooling needs.”

What is hydrogen energy storage property?

Hydrogen energy storage property includes property (other than property primarily used in the transportation of goods or individuals or for the production of electricity) that stores hydrogen and has a nameplate capacity of not less than 5 kWh, equivalent to 0.127 kg of hydrogen or 52.7 standard cubic feet (scf) of hydrogen.

Related links

- Russia s unlimited energy storage equipment

- Production of energy storage batteries for power generation equipment

- South African Republic Energy Storage Module Equipment Company

- Belarusian energy storage equipment box price

- Israel Valley Energy Storage Equipment Manufacturer

- Mexico Home Energy Storage Equipment Processing Plant

- Equipment required for producing energy storage cabinets

- Energy storage equipment 215kw

- Photovoltaic equipment energy storage system

- How much does energy storage equipment usually cost