Is there any government subsidy for industrial energy storage equipment

Welcome to our dedicated page for Is there any government subsidy for industrial energy storage equipment ! Here, we have carefully selected a range of videos and relevant information about Is there any government subsidy for industrial energy storage equipment , tailored to meet your interests and needs. Our services include high-quality Is there any government subsidy for industrial energy storage equipment -related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Is there any government subsidy for industrial energy storage equipment , including cutting-edge home energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

Impact of government subsidies on total factor productivity of energy

Government subsidies are an important means to guide the development of the energy storage industry. As countries around the world are increasing government subsidies

Incentives for renewable energy in the Philippines – Helios

The Renewable Energy Act of 2008 is a landmark legislation that aims to accelerate the exploration and development of renewable energy resources. This law provides a

Find funding to help your business become greener

Almost £5 billion of funding is available to help UK businesses become greener as part of the government''s commitment to reach net zero emissions by 2050.

Funding and Incentives Resource Hub | Better Buildings Initiative

The Clean Hydrogen Manufacturing Recycling Program is designed to provide federal financial assistance to advance new clean hydrogen production, processing, delivery, storage, and use

How does the government subsidize enterprises to install energy storage

The government provides financial support through various mechanisms to encourage enterprises to invest in energy storage, including 1. direct grants, 2. tax incentives,

The State of Play for Energy Storage Tax Credits – Publications

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits

Battery Storage Incentives by State

Maximize battery storage savings with federal and state incentives like SGIP and ITC. Learn how PowerFlex helps businesses optimize energy investments.

The State of Play for Energy Storage Tax Credits –

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

Biden-Harris Administration Announces $4 Billion

DOE is partnering with Treasury and IRS to implement the Qualifying Advanced Energy Project Tax Credit (48C) funded by the President''s Inflation Reduction Act. DOE''s

Financing and Incentives

Consumers can find financial incentives and assistance for energy efficient and renewable energy products and improvements in the form of rebates, tax

Financial incentives by province and territory

Select your province or territory to see what financial incentives or programs are available. A grouping of incentives related to energy efficiency from

Funding Opportunities | Manufacturing.gov

Small to medium-sized manufacturers that receive a qualified energy assessment can apply for grants of up to $300,000 anytime throughout the year; applications will be reviewed quarterly.

State-Level Energy Storage Incentives in the US

Comparable programs considered for this report include the Connecticut Energy Storage Solutions program, the Massachusetts and Rhode Island ConnectedSolutions

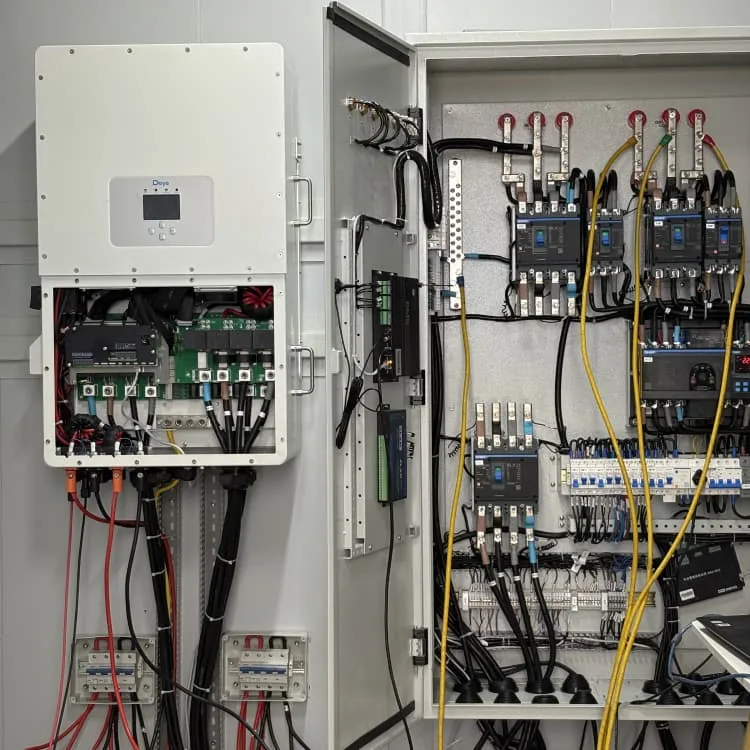

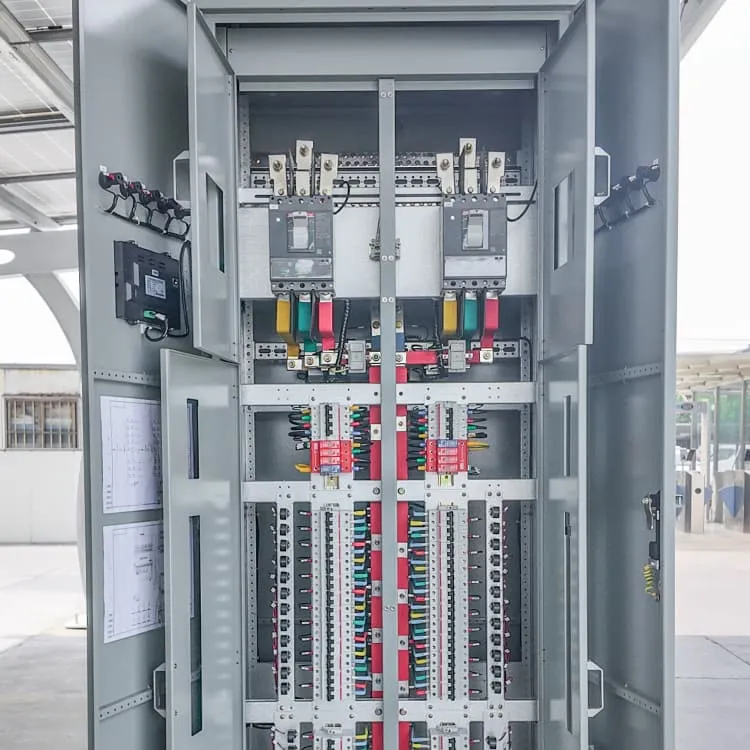

Commercial and industrial energy storage is General

Industrial and commercial energy storage encompasses the deployment of energy storage equipment systems on the electricity

Incentives | Generac industrial Energy

Most battery energy storage projects qualify for a substantial 30% tax credit under the Inflation Reduction Act. This incentive alone significantly reduces the initial investment required.

Biden-Harris Administration Announces $4 Billion

DOE is partnering with Treasury and IRS to implement the Qualifying Advanced Energy Project Tax Credit (48C) funded by the

How Inflation Reduction Act reforms U.S. energy storage market?

The act substantially boosts solar, wind, and battery industries, as well as the energy storage market. It is the first to provide Investment Tax Credit (ITC) for standalone

Federal Incentives for Renewable Energy and Energy

The Renewable Energy and Energy Storage Invest-ment Tax Credit is a refundable tax credit allowing taxpayers and corporations that invest in renewable energy systems and energy

New Subsidy schemes for Battery Energy Storage

In autumn 2024 two draft regulations were published regarding state aid for large-scale electricity storage systems (BESS), one from the

Incentives | Generac industrial Energy

Most battery energy storage projects qualify for a substantial 30% tax credit under the Inflation Reduction Act. This incentive alone significantly reduces the initial

Union Budget 2025 Expectations: A Push for Renewable Energy

Union Budget 2025 Expectations: A Push for Renewable Energy Growth with Subsidies, Incentives, Innovation With a solid policy framework and strategic investments,

New Federal Funding for Energy Storage: What''s Available and

The US Department of Energy has several new, large funding budgets for energy storage projects, research and development. Within the Infrastructure Investment and Jobs

Industrial Energy Transformation Fund

The Industrial Energy Transformation Fund (IETF) supports the development and deployment of technologies that enable businesses with high energy use to transition to a low

Funding and Incentives Resource Hub | Better

The Clean Hydrogen Manufacturing Recycling Program is designed to provide federal financial assistance to advance new clean hydrogen production,

How does the government subsidize enterprises to install energy

The government provides financial support through various mechanisms to encourage enterprises to invest in energy storage, including 1. direct grants, 2. tax incentives,

How much is the government subsidy for energy storage in Foshan?

1. The government subsidy for energy storage in Foshan amounts to approximately 25% to 30% of the total investment cost, 2. Various forms of financing and support

NJDEP| Clean Energy | Incentives

NJDEP| Clean Energy | Incentives | Page DescriptionENERGY STAR Energy Star is the federal government-backed symbol for energy efficiency, providing simple, credible, and

Massachusetts Energy Rebates & Incentives | Mass.gov

Massachusetts offers some of the best energy rebates and incentives in the country. This guide will help consumers, businesses and municipalities find information on the energy efficiency

FAQs 6

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

How much do state energy storage incentives cost?

• At the time of this report, average residential/small commercial energy storage incentive rates for the state programs examined ranged from $350/kWh to $1,333.33/kWh, with a mean rate of $805/kWh. • State policymakers should consider combined up-front and performance-based incentives.

What regulatory guidance has the government released on energy storage?

Of particular importance to the energy storage industry, the government has released final regulatory guidance for the ITC (both Section 48 and 48E of the Code), prevailing wage and apprenticeship (PWA) requirements, and transferability and direct payment, as well as other guidance on the energy community and domestic content tax credit “adders.”

Are state incentives necessary to increase distributed storage deployment?

• Despite all these variables, numerous studies as well as experience have shown that until energy markets mature, battery prices fall, and currently non-monetizable energy storage services become monetizable, state incentives are a necessary and critical key to increasing distributed storage deployment.

What are the different types of energy storage incentives?

In addition, there are other types of energy storage incentives that have been tried. For example, storage may be added to existing renewable programs, such as solar incentive programs, or be made eligible for market-based programs such as utility renewable portfolio standards (RPS).

Are IRA tax benefits a viable option for energy storage facilities?

While the vitality of the IRA tax benefits in their current form is currently subject to uncertainty given the results of the 2024 federal general election, the existing market practice for financing energy storage facilities since the IRA’s passage continues to evolve in reaction to the act’s new requirements and opportunities.

Related links

- Industrial energy storage equipment production

- Industrial and commercial equipment energy storage processing

- Australian Industrial and Commercial Energy Storage Equipment

- Industrial small energy storage equipment

- Industrial and commercial energy storage cabinet equipment

- Kuwait Industrial and Commercial Energy Storage Cabinet Equipment Manufacturer

- Hybrid energy storage configuration for industrial equipment in Ireland

- Industrial and Commercial Energy Storage System Equipment Factory

- What is industrial and commercial energy storage cabinet energy storage equipment

- Government subsidies for energy storage projects