Tax rate for imported energy storage battery cabinets in Kazakhstan

Welcome to our dedicated page for Tax rate for imported energy storage battery cabinets in Kazakhstan! Here, we have carefully selected a range of videos and relevant information about Tax rate for imported energy storage battery cabinets in Kazakhstan, tailored to meet your interests and needs. Our services include high-quality Tax rate for imported energy storage battery cabinets in Kazakhstan-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Tax rate for imported energy storage battery cabinets in Kazakhstan, including cutting-edge home energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

Indirect tax

This tax guide provides an overview of the indirect tax system and rules to be aware of for doing business in Kazakhstan.

High taxes on battery imports undermine India''s renewable energy

But wind and solar need battery storage, devices that enable renewable energy to be saved and released when needed. Combined customs and imports on battery storage

Tax rates in Kazakhstan

A property tax is levied at rates varying between 0.1% and 1.5% (the most common rate) of the average net book value of the immovable property, depending on the taxpayer''s activity.

Kazakhstan

The tax rate is set at KZT 2 per kilowatt-hour of electrical energy consumed depending on the amount of electricity consumed. The tax period is a calendar quarter.

Indirect tax

Standard rate of 12% for most goods and services. Financial, educational, medical, veterinary, services, pharmaceuticals, land and

Electric Vehicles in Kazakhstan: What is already available and

There are advantages for import of electric cars - neither customs duties nor excise taxes are to be paid for them. Also, in order to stimulate sales, the state partially

Kazakhstan

Our tax solutions are based on the extensive knowledge and experience of our specialists, enhanced by our methodologies. Our client base covers all sectors of the

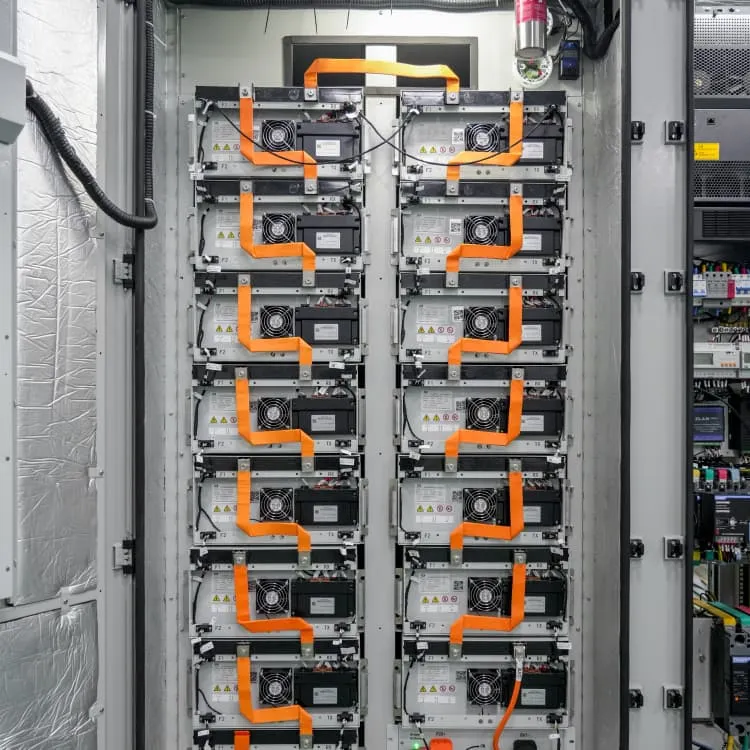

ESS Cabinet

In addition to our Energy Container Solutions, this ESS cabinet offers a compact system in a robust outdoor housing as the ideal energy storage solution for a

Trump''s 1930s-era tariffs bring China battery tariff to 82%

Trump has announced his sweeping ''Liberation Day'' global tariffs, with a new China duty bring the effective tariff on batteries to 82%.

Kazakhstan

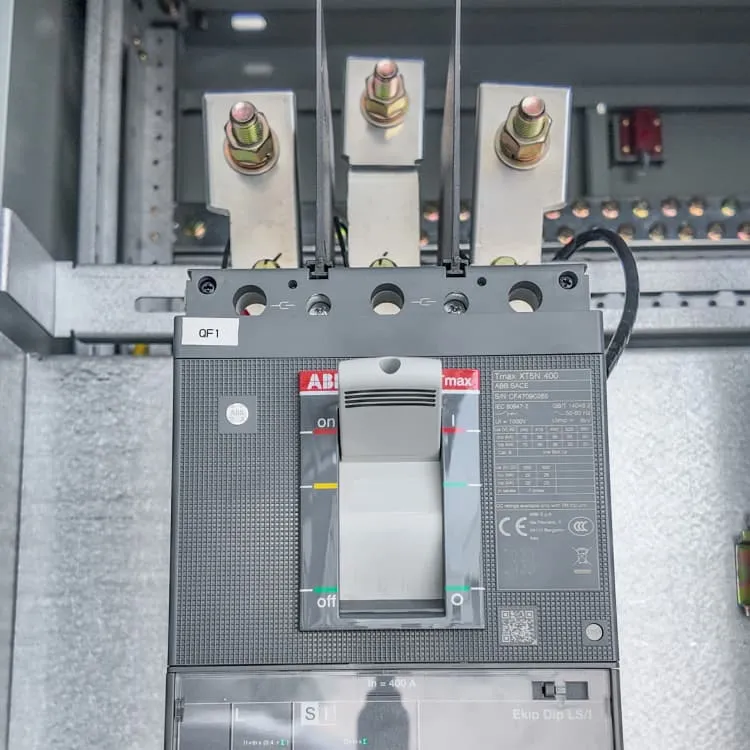

According to EEU and Kazakhstan customs legislation, depending on the customs procedure applied, customs declaration involves payment of any of the following: 12% import

Ship to KAZAKHSTAN :KAZAKHSTAN Tariffs and

The accurate import duties can only be known after the goods have been assessed by KAZAKHSTAN customs. For tariff reference, please refer to the

How much is the tariff for imported energy storage equipment?

Tariffs for imported energy storage technologies can range significantly, influenced by multiple factors, including the type of equipment and trade agreements. Understanding

Indirect tax

Standard rate of 12% for most goods and services. Financial, educational, medical, veterinary, services, pharmaceuticals, land and residential buildings are exempt from VAT.

Energy Storage Systems: Regulation and Incentives in

It is planned to approve a tariff for the service of availability of ESS capacity for a term of 15 (fifteen) years.

Ship to KAZAKHSTAN :KAZAKHSTAN Tariffs and Customs Fees

The accurate import duties can only be known after the goods have been assessed by KAZAKHSTAN customs. For tariff reference, please refer to the KAZAKHSTAN tariff and

Kazakhstan Tariff Rate | TariffCheck

Currently, the tariff rate for 25% applies to imports from Kazakhstan. This represents additional costs that importers pay when bringing goods into the

How much is the tariff for imported energy storage

Tariffs for imported energy storage technologies can range significantly, influenced by multiple factors, including the type of equipment

Tariff uncertainty grips U.S. battery development

The Trump administration''s China tariffs have piled atop existing and developing trade barriers on battery energy storage systems,

Kazakhstan Almaty Energy Storage Cabinet Project Powering a

Why Almaty Needs Advanced Energy Storage Solutions As Kazakhstan''s largest metropolis, Almaty faces growing energy demands and increasing pressure to adopt renewable energy.

Tariffs: Analysis spells out extent of challenge for US

New analysis from Clean Energy Associates (CEA) and Wood Mackenzie highlights the challenges facing the US battery storage market due

US: IRS modifies BESS domestic content cost

The headquarters of the IRS in the US. Image: Wikicommons / Joshua Doubek. The IRS has released an amended cost breakdown of BESS

Kazakhstan

Includes information on average tariff rates and types that U.S. firms should be aware of when exporting to the market.

ENERGY STORAGE SYSTEMS IN KAZAKHSTAN: TIME FOR

Energy storage technologies emerged as a critical component in efficient, flexible, reliable use of energy worldwide. They help smoothing out supply of various forms of renewable energy.

Energy Storage Systems: Regulation and Incentives in Kazakhstan

It is planned to approve a tariff for the service of availability of ESS capacity for a term of 15 (fifteen) years.

Taxation in Kazakhstan

The main legal act establishing and regulating taxation in Kazakhstan is the Code of the Republic of Kazakhstan On Taxes and Other Obligatory Payments to the Budget (the " Tax Code ").

U.S. Tariffs on Chinese Lithium Batteries: Full Breakdown

U.S. tariffs on Chinese lithium batteries have become a critical factor shaping the global battery market in 2025. These tariffs directly impact lithium-ion batteries'' cost, supply

Kazakhstan Tariff Rate | TariffCheck

Currently, the tariff rate for 25% applies to imports from Kazakhstan. This represents additional costs that importers pay when bringing goods into the United States from Kazakhstan.

Kazakhstan EV Profile: Local EV Market Still Finding

This means that the increased EV production in Kazakhstan, Uzbekistan and Azerbaijan in 2024, will offer strong upside risk to passenger

US suppliers back Chinese lithium-ion battery tariff

The American Clean Power Association (ACP) has approved the Biden Administration''s decision to impose Section 301 tariffs on lithium-ion

Related links

- What is the tax rate for photovoltaic energy storage companies

- What is the tax rate for chemical energy storage projects

- Malaysia battery energy storage rate

- High rate and large capacity energy storage battery

- Battery energy storage conversion rate

- Imported energy storage battery models

- Nepal imported energy storage battery merchants

- Imported energy storage battery brand

- Colombian imported energy storage battery merchants

- Imported energy storage battery merchants